capital gains tax changes proposed

13 2021 if passed. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

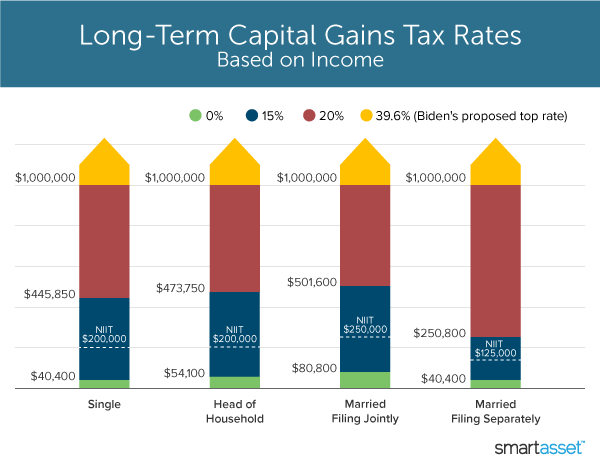

President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

. The new tax plan proposes a tax hike for the top income tax bracket increasing it from 37 to 396. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a.

The ALPs proposed ban on negative gearing has been well publicised and debated. In the US long-term gains currently face a top marginal tax rate of 238 percent at the federal level the result of a maximum 20 percent capital gains tax rate plus a 38 percent net investment income tax. 12published january 12 2021updated february 9 2021.

However its proposed changes to Capital Gains Tax CGT have received far l. In his budget plan released may 28 biden proposed making the capital gains tax changes retroactive to april 2021 in order to prevent wealthy. Under current law the capital gains tax that is avoided has a maximum rate of 20.

Currently the highest capital gain rate is 20 but you must add the 38 Obamacare tax. Although the concept of capital gains tax is not new to Canadians there have been several. The government levies a capital gains tax on profits that are incurred from investments when they are sold.

How about long term capital gains. Biden Administration Green Book proposals. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Understanding Capital Gains and the Biden Tax Plan. Tax capital income for high-income earners at ordinary rates. The tax hike would apply to households making more than 1 million.

1 day agoOn August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft legislation and make certain technical changes Proposal. The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income MAGI above 25. The Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be subject to a three-year.

However some experts suggest that the higher the tax rates on capital gains the more likely it is that individuals will wait to sell their capital assets therefore deferring the tax due. Right now if there are three different people from three different industries working on the same deal one would pay half the tax rate on his or her income from the deal that the others pay because of the carried interest loophole. The proposed increase in capital gains tax would raise the tax from 20 percent to the highest of 396 percent affecting the wealthiest taxpayers on gains realized after Sept.

Accounting for such tradeoffs the Penn Wharton Budget Model estimated that increasing the top rate from 20 percent to 242 percent would increase revenues by 66 billion over a 10-year. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

Changing that maximum rate to 396 for certain taxpayers would mean that significantly more tax could be avoided through a charitable gift greatly incentivizing gifts of these appreciated investments. These higher taxes would apply. It would apply to those with more than 1 million in annual income according to Bloomberg.

The new tax laws. Possible Changes Coming to Tax on Capital Gains in Canada. Additionally there has been a proposed increase to the capital gains tax from 29 to almost 49 if including top state and federal tax.

Increase the Top Income Tax Rate. Would eliminate the step-up exemption on any inherited asset that has gained more than 1 million in value between purchase and death. This proposed change would tax carried interest as ordinary income instead of as capital gains which it currently does.

The draft legislation includes measures first announced in the 2022 Federal Budget with updated versions of draft. President Bidens tax plan proposes a number of changes to capital gains tax that could have a major impact. The top rate would jump to 396 from 20.

Reforms to the taxation of capital gains and qualified dividends would it is said reduce economic disparities among Americans and raise needed revenue. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. The capital gains tax rate is proposed to go up from 20. Capital gains taxed as ordinary income over 1M.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Proposed Tax Changes For High Income Individuals Ey Us

The Capital Gains Tax And Inflation Econofact

What S In Biden S Capital Gains Tax Plan Smartasset

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Short Term Vs Long Term Capital Gains Below Infographics Details The Top 5 Differences Between The Short Term Vs Long Te Capital Gain Capital Gains Tax Term

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Guide Napkin Finance

Canada Capital Gains Tax Calculator 2022

Income Tax Law Changes What Advisors Need To Know

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How New Capital Gains Rules May Drastically Impact Your Tax Situation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)